Product Positioning for Product Managers

A key responsibility for Product Managers is to define how their products are positioned in the market. Pricing, user experience, features, performance, branding, customer service and partnerships influence how target customers perceive the value of one product relative to alternatives in established markets.

Porsche, Audi and Volkswagen coexist in the same automotive market as global brands with unique products as a portfolio within VW Group. This is the result of unique product positioning. A customer in the market for a Porsche is likely not considering a Volkswagen and visa versa. But a target customer for Audi may perceive higher value due to the connection to Porsche.

Land and expand strategies explained

New markets and disruptive products have more latitude to redefine what customers perceive and want. For example, Cash App users may download the free app to receive a reimbursement from a friend or family member, but then decide they prefer the user experience and add direct deposit. Next, they add a debit card and eventually start buying some ETFs and Bitcoin.

All these services that compete with local banks are possible with the same app downloaded for peer-to-peer payments. This is what is called a “land and expand” strategy with a low barrier to try a product. Over time, revenue generating services are added to address specific needs for the customer. And the Cash App ecosystem provides an effective customer acquisition strategy for the Square ecosystem under parent company Block.

Product Positioning – Case Study – Arcimoto

Arcimoto (NASDAQ: FUV) is an electric vehicle company based in Eugene, Oregon. The company’s mission is to catalyze the shift to a sustainable transportation system. But the mission includes a twist. Arcimoto believes this shift will be realized when we move away from oversized, overpriced, polluting vehicles to right-sized, ultra-efficient, affordable electric vehicles (EVs).

Mark Frohnmayer is the Founder and CEO of Arcimoto. He founded the company after selling his software company Garage Games and decided to pursue the EV market with a smaller format vehicle design. The product strategy was to drastically reduce the weight of the vehicle to reduce the material and battery requirements. Key outcomes included greater energy efficiency and lower material costs. These would also lower the final retail price and the total cost to operate the vehicle.

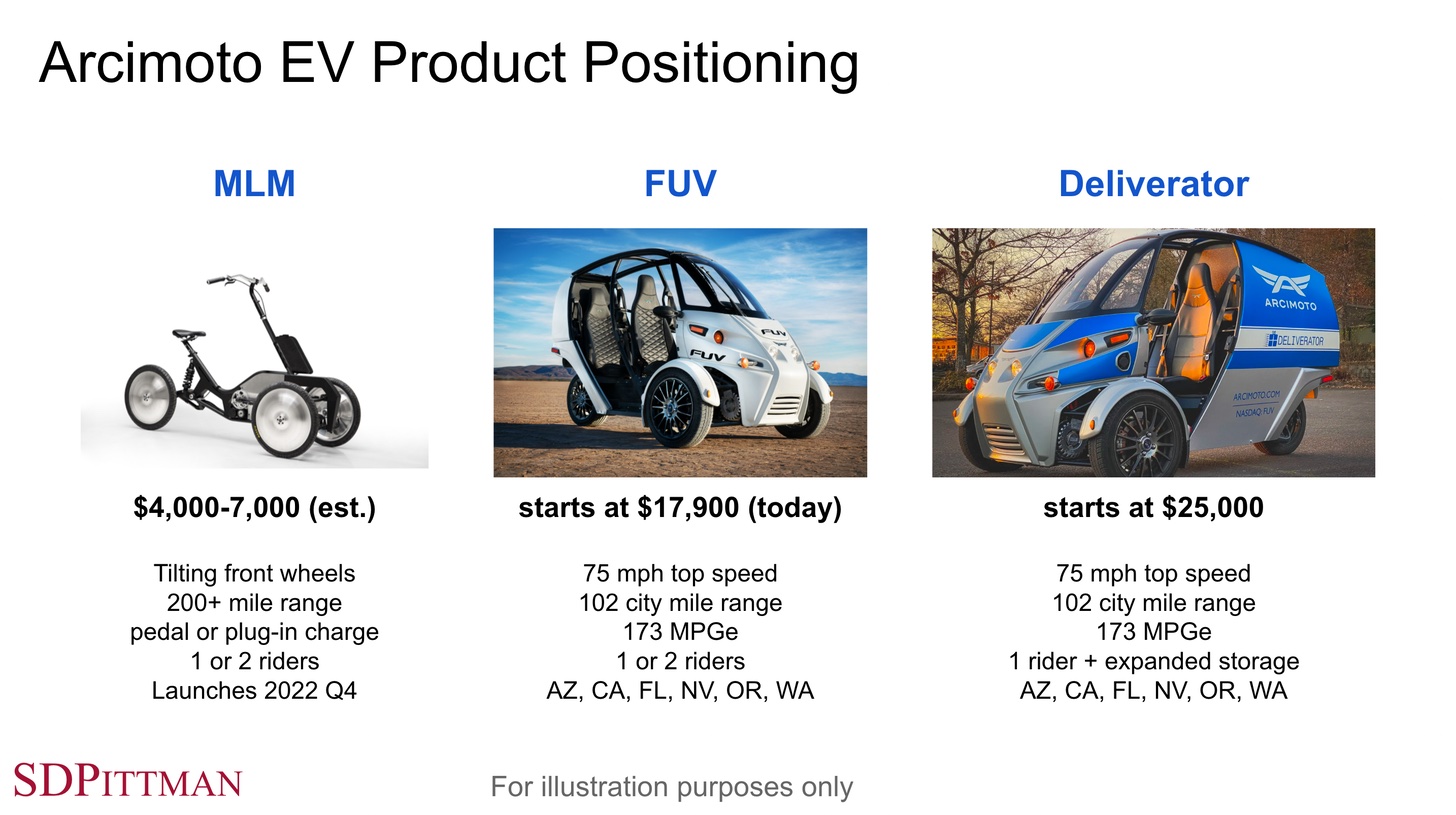

One of their products is the Fun Utility Vehicle (FUV), a tandem 2-seater on 3 wheels in a reverse trike configuration to improve stability plus front-wheel drive, dual, independent electric motors. A low center of gravity and a curb weight of 1,300 pounds add further safety. The steel frame also meets the roof crush resistance standard for a passenger car. But just subtracting the bulk weight of a conventional automobile design helps improve the energy efficiency to 173 miles per gallon equivalent (MPGe).

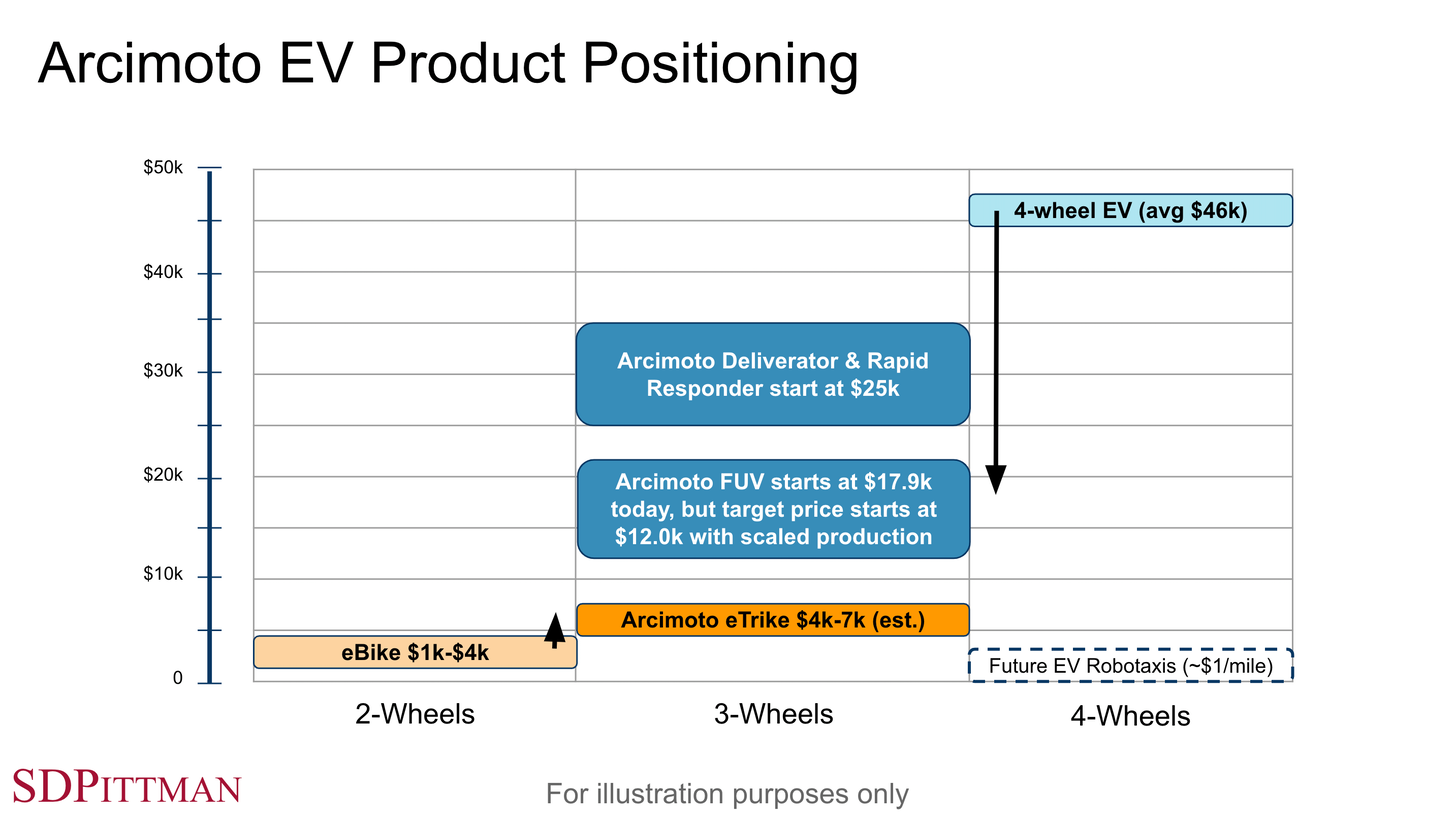

The target retail price for the FUV starts around US$12,000 with scaled production in 2-3 years. But the current retail price with low volume production starts at US$17,900. The average retail price for more standard 4-wheel EVs is around US$46,000 with more popular models like the Tesla Model Y starting at US$62,990. The FUV is well positioned as a more affordable EV option for short commutes and running errands around town using a second vehicle.

Arcimoto announced in January 2021 it was acquiring the Tilting Motor Works in Eugene, OR to use its patented tilting trike technology for new products focused on micromobility. Earlier this year, Mark Frohnmayer revealed a third generation prototype eTrike with tilting technology to improve maneuverability.

Arcimoto calls this eTrike the Mean Lean Machine (MLM) with a target product launch in Q4 of this year (2022). The starting retail price for the MLM has not been announced yet, but using eBikes as a proxy, I estimate the price will range between US$4,000-7,000 depending on what is included in the base configuration.

I think the MLM configuration and price will be carefully positioned to help sell more FUVs. The perceived value will be to showcase many more features on the FUV, but with a reasonable increase in price compared to the MLM. I don’t see the MLM being positioned to cannibalize FUV sales, but individuals in urban areas may really like the more compact design. The market will judge. And Arcimoto may be able to improve gross margins faster on the MLM than FUV as unit production ramps.

eBikes have grown in popularity in recent years with the majority priced between US$1,000 – 4,000. But eBikes have constraints on battery size, range and stability with only 2 wheels. They are also much heavier than conventional bikes, but assist with climbing hills. Arcimoto must be predicting they can upsell consumers considering an eBike to an eTrike with more stability and range. The Arcimoto MLM will also include options to protect the rider from the elements and a tandem configuration.

Looking only at price, Arcimoto is doubling down on EVs with a range of options based on 3 wheels for consumers ranging from the MLM and FUV to businesses with the Deliverator and Rapid Responder. Fleet sales are also possible at popular travel destinations for businesses to rent FUVs. Deliverator fleets for brands like DoorDash, UberEats, Grubhub and Postmates will enable rentals for the gig economy in key markets.

The figure above illustrates how the Arcimoto MLM (eTrike), FUV, Deliverator and Rapid Responder 3-wheel configurations address multiple applications with prices ranging from an estimated $4,000 to $35,000 compared to a $46,000 average price for 4-wheel EVs.

The figure above illustrates how the Arcimoto MLM (eTrike), FUV, Deliverator and Rapid Responder 3-wheel configurations address multiple applications with prices ranging from an estimated $4,000 to $35,000 compared to a $46,000 average price for 4-wheel EVs.

Arcimoto estimates the materials and batteries used to make 1 GMC e-Hummer could produce 2 Tesla EVs, 8 Arcimoto FUVs and 100 Arcimoto MLMs. Until autonomous EV Robotaxis are readily available for scaled ride-sharing priced at US$1 or less per mile, Arcimoto accelerates what 4-wheel EVs can achieve at higher retail prices for the transition to sustainable energy.

Lithium-ion batteries and semiconductor chips will continue under supply constraints near-to-midterm while the demand for EVs starts an exponential ramp. Tesla has raised EV prices multiple times over the last year to help balance their supply and demand. That demand for EVs will likely further accelerate if gasoline prices continue to go up.

If supply constraints persist and prices continue to increase, the demand for material conserving and lower priced options from Arcimoto could increase. This means product positioning for 3-wheel, reverse trike EVs could be even more important to accelerate the transition to sustainable energy. The MLM could play a critical role to convert prospects who do not want to commit to the higher priced FUV, but are eager to adopt an EV for reasonable commutes that are beyond what they want to do on bicycle.

And the Deliverator provides a strong value proposition for branded EV fleets to serve the need for last mile delivery in urban areas. Food, groceries, medications, flowers, packaged goods and electronics are easily delivered with this EV configuration that disrupts conventional 4-wheel options. And the higher Deliverator pricing is supported by business use cases.

The minimal form factor of the MLM helps support that more features on the FUV should cost more. And the higher priced Deliverator helps anchor the FUV to the current US$17,900 starting price until volume production can help lower the starting FUV price closer to the MLM price range. The MLM and Deliverator both work as bookends to support the pricing for the FUV.

Weather will be an issue in winter months for many geographies like the Northeast U.S. even with accessories to enclose the Arcimoto EVs. These EVs are not intended as a replacement for a primary vehicle for families with young kids or even individuals with long commutes. But Arcimoto EVs are a viable option for shorter commutes and as a second vehicle to run errands even for families. Arcimoto EVs are currently only available for sale in Arizona, California, Florida, Nevada, Oregon and Washington, but as Arcimoto scales production in its new facility, they will continue to expand sales to other states.

Arcimoto’s 3-wheel reverse trike EVs for 1 or 2 riders are a substantial pivot from the conventional 4-wheel coupe, sedan, SUV, pickup truck, van and sports car designs. But Arcimoto’s expanded EV product line ranging in price from an estimated $4,000 to $35,000 could drive revenue growth much faster at the right prices than the FUV design alone.

And the Deliverator and Rapid Responder are really just a final configuration on top of the FUV chassis to help streamline a large portion of the EV production. This year will be important for Arcimoto to ramp production towards its target 1,000 FUVs (including Deliverators, Rapid Responders and other designs built on the FUV chassis) per week by 2025 at its primary factory.

Key takeaways for product managers

So what are some key takeaways from the Arcimoto case study and product positioning in general?

1. Multiple products can enhance product positioning across key price points relative to the competitive landscape.

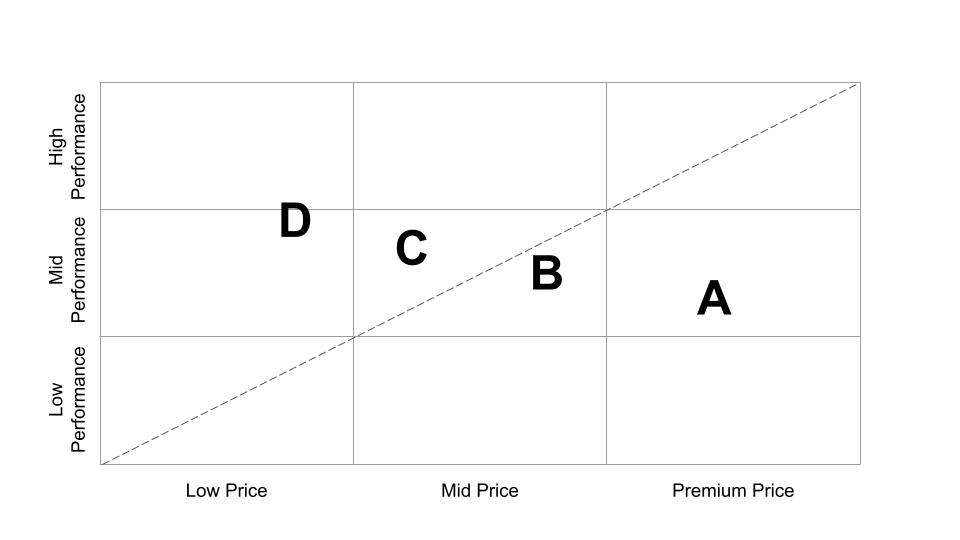

Multiple products are illustrated in the figure above with increasing price on the X-axis and increasing performance on the Y-axis. So, a low-end product would be on the bottom left section and a high-end product would be on the top right section.

Product “x”, “Y” and “Z” represent a product portfolio strategy seeking to drive adoption of higher performance products at higher prices. “Z” is positioned to establish significant price differential with “Y”. This makes “Y” with higher performance in its class seem like a good value relative to “Z”. And “x” is positioned to further establish the superiority of “Y” while also serving the low-end market with better pricing for the performance provided.

This strategy would be appropriate to drive higher gross margins with more premium products. Brand is important and synergies between high performance products should be leveraged to aid the mid-performance products. This can happen using a common platform or core branded technologies.

2. Careful positioning between multiple products can be used for product strategy to bias preference towards a specific product.

Product “XX” in the figure above is positioned more competitively within the low end to “x” on performance and relative to “yy” on price. And “yy” is priced more favorably on price relative to “Y”. So, both products “XX” and “yy” work together with their positioning to convert more sales primarily for “XX” where the market is likely bigger with lower price. Product Z positioning has less impact on this strategy focused on sales for “XX” and “yy”.

3. Positioning can also be used to facilitate strategy with phased deployments.

Product sales and services associated with wearables, smart devices, and other smart hardware technologies require negotiating the scope and terms for an initial deployment to validate key business assumptions. Some product companies use no-cost trials to lower the burden for client companies to try their technologies.

I want clients to have skin in the game with a purchase order. But to derisk something that is new, I also like to propose an “Alpha deployment”. I call it this because it the first deployment of a product for a specific customer even if it in use at many other companies. Instead of a 90-day trial that ends, this is the leading edge of an ongoing deployment that requires a minimum of 90-days. It then renews automatically month-to-month until either upgraded to a “beta deployment” or canceled with 30-days notice.

Because the scope is limited to 90 days and then month-to-month and scale is around 50-100 devices, the subscription services are priced high “A” in the figure above and the devices are at full list price. But the total cost is managed with the smaller scale. Price is reduced by increasing the scope (for example: 12 months) and scale (for example: 1,000 devices).

But the keys to success with these “Alpha deployments” are the following:

- Define Objectives to validate customer success over an 8 week program.

- Break down the 8 weeks into 2-week deployment sprints. Each sprint should have Key Results to track progress against the 8-week Objectives.

- Use a Learning Plan to capture key insights into what isn’t working, what is working and feedback on how to improve product features, training, communications, etc.

- Organize post-sprint updates / data reviews with the customer to keep key stakeholders engaged regarding progress and next steps.

- Pitch “Beta deployment” scaling plan recommendations along the way and in its complete form using the 8-week program results. The subscription services are priced lower with more scope and scale “B” in the figure above. A 10x step up is the objective to test more detailed Objectives.

With Product, Sales, Customer Success and Engineering teams working together as deployments scale within a key account, the product experience and services improve in performance relative to the customer’s specific needs. Thus, as deployments scale by 10x with each key step, subscription price can drop while performance improves as shown going from “A” to “B” to “C” to “D”. This win-win outcome is the result of collaboration towards common goals. And an “Alpha deployment” starting with 100 devices can reach 100,000 devices when you reach “D” for a “Delta deployment” and can keep scaling using the same process for large enterprise accounts.

Stephen is the General Manager for Wearables at Apnimed, Inc., a clinical-stage company based in Cambridge, MA dedicated to the discovery of novel therapies for sleep apnea and related disorders. Prior roles include leading Product for clients through his own company SD Pittman & Co plus Luminopia, Philips and Respironics spanning wearables, digital therapeutics and medical devices. Stephen holds both a BS & MS in Biomedical Engineering from Tulane University and is an alumnus of Harvard Business School.

sdpittman.substack.com