How to measure product market fit

6 indicators to help you build products people love

Product-market fit describes the stage of a company where they have successfully identified a target customer and are serving them with a product that meets the customer’s needs well. Marc Andreessen defined product-market fit as “being in a good market with a product that can satisfy that market.”

Andreessen goes on to say

“You can always feel when product-market fit isn’t happening. The customers aren’t quite getting value out of the product, word of mouth isn’t spreading, usage isn’t growing that fast, press reviews are kind of “blah”, the sales cycle takes too long, and lots of deals never close.”

Product-market fit typically occurs during the first 2-3 years of a company’s lifespan. If a company fails to achieve product-market fit during this time, they usually are forced to pivot or shut down due to a lack of funding.

If you’re fortunate enough to be working at a company that’s been around for a couple of years, you may be wondering if your company has product-market fit. Eric Ries, the author of The Lean Startup, once said “If you have to ask whether you have product-market Fit, the answer is simple: you don’t.”

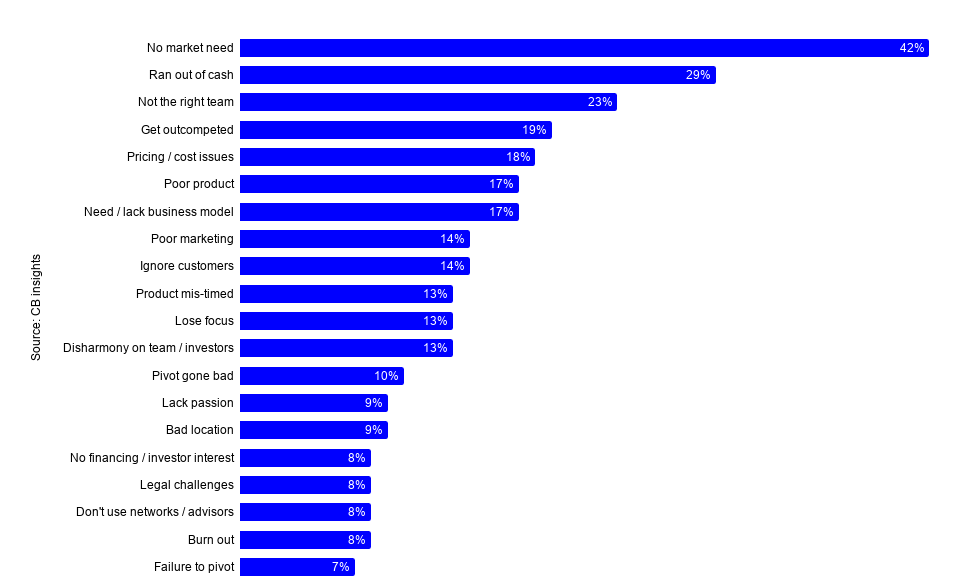

A better question to ask might be “When will we have product-market fit?” Why? Because the next step after achieving product-market fit in a startup’s lifecycle is to scale. And scaling before a company has product-market fit can be the kiss of death. According to a study by CB Insights, lack of market need is the #1 killer of startups. Not having a market need means these companies never achieved product market fit.

Here are the top indicators that you have (or about to have) reached product-market fit.

1. Your company is starting to feel like it can’t keep up with demand

Many startup founders use scaling as a way to drive growth. They think if they double the number of employees, they can double the rate at which they release products. They extend this double/double/double assumption to then forecast that they will also double their revenue or number of customers. However, scaling too soon is often the cause of death for startups. Why? Because scaling blows through cash in a startup. If you don’t have enough revenue coming in to offset the cost of all those new hires, your startup will die.

On the flip side of the scaling coin is growing so slowly that your company is completely caught off-guard when product-market fit starts to occur. You may suddenly find usage of your product skyrocketing, and more partnership and sales deals closing than you can keep up with. This is the Catch-22 of product-market fit. You have to be prepared to recognize that it’s about to happen so that you can start to scale accordingly.

Because of this, it’s useful to think of product-market fit as a journey along a spectrum and not as a destination. A useful analogy is wading into the ocean towards the horizon. When you first dip your toes in the water, there isn’t much there. As you go deeper and deeper, the water rises. At some point, you may find yourself stepping into a sudden hole and your head goes under. Is this it, you might ask? This is likely the start of reaching product-market fit. But as you keep moving, you realize you’re not as deep as you thought, so you continue on your path towards the horizon. Once you reach that point where you can no longer keep your head above water and touch the ground is when you have to change how you’re moving. What got you to this point (walking) won’t get you any further and you need to start swimming. Now you’re in the zone of product-market fit. You can continue to swim towards the horizon but, at some point, the waves are getting bigger and the current is getting stronger. You need a raft or a boat to keep moving in the right direction. This boat is like the support you get from your colleagues as the company grows. You don’t need a boat when the water is up to your knees, but once you’re in over your head, you’re going to need help.

Remember: Scaling doesn’t drive growth. Addressing a clear customer need (and finding product market fit) drives growth.

2. You know your customer

Companies that are solving a real problem for their customers are most likely to achieve product-market fit. These are the companies that have clearly identified a target audience that they can focus on. Companies that know their customers are also not viewing themselves as the customer.

Does your company eat its own dogfood? I am referring to the process of employees using their products as a sort of testing and quality control process. While dogfooding may be an acceptable form of alpha testing your software before releasing it into the hands of your beta testers, it should not be a replacement for user research!

If you want to find Product Market Fit, you must understand your customers. If you are not talking to your customers regularly, this is the first step you should take in determining if you have product-market fit. The best way to start engaging your customers is to use the customer discovery process on a weekly or monthly basis. The practice of building customer discovery into a company’s DNA builds more successful companies, according to Steve Blank, known as the father of the lean startup movement.

The most effective way to get to know your customers is to conduct one-on-one interviews. These can be done by phone, over video conference, and in person. The product teams that do this best are talking to their customers on a weekly basis. If you can commit to doing that, you will uncover insights that provide substantial context to the quantitative data covered in the next section.

If talking to lots of customers every week seems daunting, you may want to establish a customer advisory board (CAB). A well-run CAB can unlock insights into your customer base in a way that scales, especially if you are the only product manager at your company. Time is precious and a CAB is an efficient way to learn about your customers. To form a CAB, look for 5-7 customers whom you’ve talked to that are good at articulating how they work, what their biggest problems are and welcome the chance to provide feedback. CAB meetings should be held monthly or quarterly.

Another approach is to ask your customer support team to provide you with a list of the top complaints they receive from customers. Take this with a grain of salt, though. I’ve seen customer support teams prioritize the feedback based on their perception of which issues are the most critical. How they view the biggest issues is typically based on things like the average duration of calls to resolve an issue.

3. You measure what matters

In addition to talking to your customers, you also need quantitative data to determine if you have product-market fit. If you don’t have a good system in place, start measuring using a framework that works best for your company’s business. The framework I recommend to most of my clients is the Pirate Metric Framework. Pirate Metrics were coined by Dave McClure in 2007. Here’s a link to his presentation where he first describes this framework. He breaks it down into 5 components.

- Acquisition – how well are you getting customers to your site or app?

- Activation – are your customers having a great ‘first run’ experience?

- Retention – how often are your customers coming back?

- Referral – are they telling others about your product?

- Revenue – are they paying for your service? Are you able to monetize your customers?

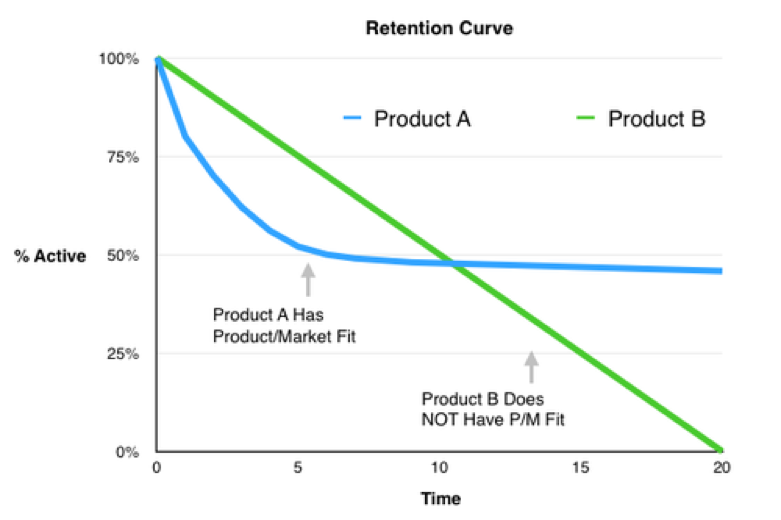

Some of the Pirate Metric components may be more relevant than others. If you’re a SAAS business, a high retention rate is an excellent indicator of product market fit. If your churn rate is less than 20%, you have a solid base of customers who are willing to use and pay for your product on a recurring basis. That is a fantastic data point and a good sign you’re on the path to product-market fit, if not already there.

As this chart from Brian Balfour shows, retention is a key indicator of product-market fit.

By developing KPIs across these 5 customer engagement themes, you should be able to start the process of determining if you’ve achieved product market fit. As part of establishing these KPIs, you and your team should also have stakes in the ground for the KPI numbers you aspire to based on industry averages. If you’re achieving product-market fit, your acquisition rate should be trending down over time while your retention rate is trending up.

Be careful to avoid vanity metrics! To compensate for a lack of product market fit, many companies will use marketing and PR to tout “successes” related to things like vanity metrics and partnerships. Just because your app has been downloaded half a million times doesn’t mean people are using it!

4. People love your product

Although measuring the emotional impact your product has on its users is highly subjective, there are a couple of ways you can measure whether people love your product.

Sean Ellis, CEO of GrowthHackers, suggests another method for quantifying Product Market Fit .

Introducing the ‘very disappointeds’

“I’ve tried to make the concept less abstract by offering a specific metric for determining product-market fit. I ask existing users of a product how they would feel if they could no longer use the product. In my experience, achieving product-market fit requires at least 40% of users saying they would be “very disappointed” without your product. Admittedly this threshold is a bit arbitrary, but I defined it after comparing results across nearly 100 startups. Those that struggle for traction are always under 40%, while most that gain strong traction exceed 40%.”

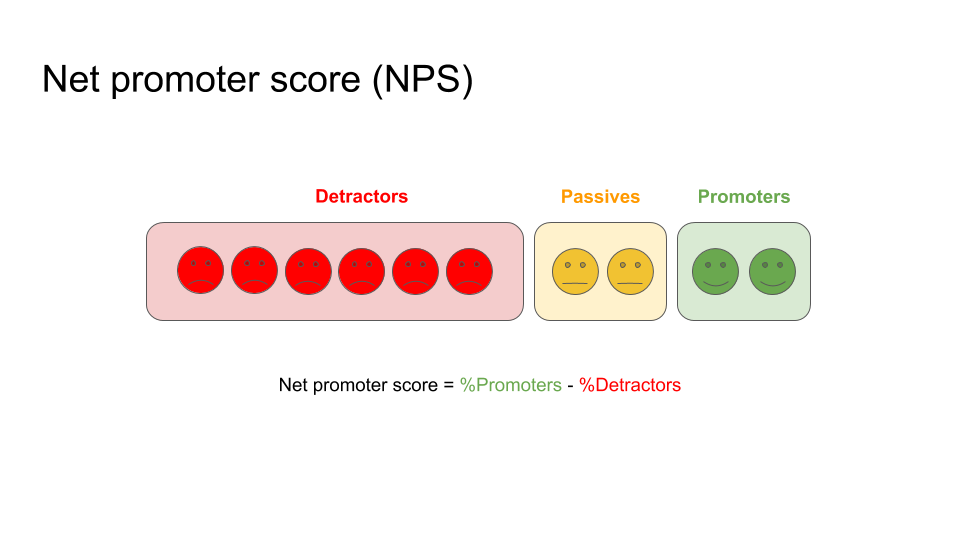

A similar method is to measure the Net Promoter Score for your company. Net Promoter Score, or NPS, is a metric that has become a standard for measuring customer loyalty and satisfaction by many companies. Built on the power of one simple question — how likely is it that you would recommend [my product] to a friend or colleague? — it’s now used by companies of all sizes in virtually every industry all over the world.

If you do measure NPS to determine customer satisfaction, take it with a grain of salt. While NPS is a good leading indicator of business growth, it can also be a vanity metric if used alone without looking at the context of why your customers would recommend (or not recommend) your product.

If your company is committed to measuring NPS, here’s a tip that you can use to understand the ‘why’ behind your NPS score and potentially increase it.

Follow up the standard NPS question with one additional question, “What would it take for you to recommend my product to someone you know?”, and target the people who are not your promoters, which means they rated their likelihood to recommend your product an 8 or lower. You can then analyze those open-ended responses to identify key trends in the data.

5. Your customer acquisition cost is lower than the lifetime value of your customer.

This is a straightforward metric you should be able to track over time. How much does it cost your company to repeatedly acquire new customers? Your customer acquisition cost (or CAC) can be calculated by dividing all the costs spent on acquiring more customers (typically these are marketing expenses) by the number of customers acquired in the period the money was spent. For example, if your company spent $10,000 on marketing in a year and acquired 1,000 customers in the same year, your CAC is $10.00.

Let’s say your customers pay $5 per year for your product, but they don’t typically renew after that first year. The customer lifetime value (CLV) is $5. That’s half of your CAC and you have likely not achieved product-market fit. In this particular hypothetical case, you could focus your efforts on retention as a means of increasing the CLV.

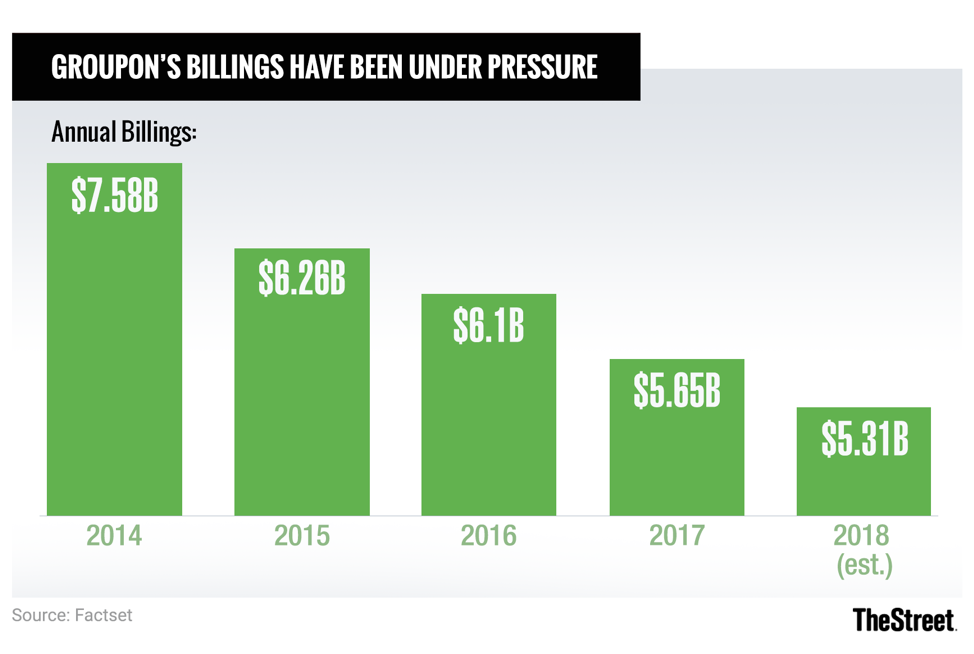

6. Your product or business model cannot be easily replicated

This is related to retention but something a good product manager should be tracking as a separate indicator as well. Is your company’s product unique? Or does it have the potential to become a commodity? E-commerce businesses, in particular, are prone to commoditization. Think back to when Groupon first emerged. Groupon may have had first-mover advantage, however, their business model was easily replicated. The barrier to entry for other e-commerce businesses was incredibly low and Groupon’s revenue has plummeted every year since 2014 as a result of competition from powerhouses like Google and Facebook.

There are undoubtedly many other factors that indicate if you have product-market fit or not. These six milestones represent the key indicators my clients have experienced.

- Your company is starting to feel like it can’t keep up with demand

- You know your customer

- You measure what matters

- People love your product

- Your customer acquisition cost is lower than the lifetime value of your customer

- Your product or business model cannot be easily replicated

Just remember. product-market fit is a never-ending journey. Once you have it, you must be vigilant to maintain it. When you add a new product or a new feature, you should ideally be experiencing an incremental increase in product-market fit. You also have to keep an eye on your market. If market conditions change, your product-market fit could be lost.

Joni Hoadley is a senior product management advisor specialising in market validation and product discovery. Joni has over a decade of hands on product management experience at market leading product companies including Sonos, AOL and more.