5 Essential Business Skills for Product Managers

As product managers we are expected to possess a combination of business skills, technical knowledge and UX / design expertise. It’s a hefty list of qualities as we rarely excel in all 3. Let’s take a look at some of the most essential business skills for product managers.

1. Market evaluation skills

Products do not exist in vacuums and there is often a tendency for product managers to get consumed by our day to day interactions and forget that there is in fact a world outside the 4 walls we spend most of our time in! This is true of both startups and larger companies and the failure to get out of the building and expose yourself to competitors and other markets can have a detrimental impact on your ability to think creatively. We’ve all been been guilty of it in the past and it’s difficult to overcome without forcing yourself out of the building and pencilling in some time outside of the office.

The ability to quickly assess a business or product idea based on the market potential is a strong skill to have and it takes a bit of practice to get to the stage where it’s second nature so that you can quickly evaluate an opportunity based on the market. When putting together strategies for a new product or shortlisting ideas for a new product, product managers should be able to conduct a quick market evaluation by asking some key questions about the market size and its competitors.

Market size

At Google, many of its products are considered worthy contenders if they solve a problem for a billion people.

Whilst you might not be targeting a billion users yourself, if you’re going to be investing a bunch of engineering time and effort into building a new product, you need to fully consider how big the opportunity is.

- Will this product serve our existing customers? If so, how many of our existing customers will it solve problems for?

- Will it target or attract new customers and new segments?

- How big is this new market vs. our existing market?

- What market do you truly operate in?

Before developing new products you should have some numbers which answer these questions and a researched perspective on the actual size of the opportunity so that you can effectively prioritise and make decisions based on the market opportunity.

Larger companies typically have business analysts / researchers who can help you to get the data to conduct this type of analysis but in smaller companies you may have to do the digging yourself.

If you have no idea where to start learning about how to size markets, here’s some useful tools and resources for sizing markets:

- Built with – a tool that allows you to check web traffic by verticals, which gives you an insight into potential numbers for industries

- Wikipedia’s Population by country – As weird as it sounds, it’s a good idea to know roughly the population of every major country in the world as it gives you a sense of perspective and allows you to compare and contrast larger markets such as the US, China, India with smaller markets such as the UK. Population by itself isn’t the only important factor when determining market size as it clearly depends on the category of the market itself but just knowing these numbers does help you to make assumptions and rough models when building business models.

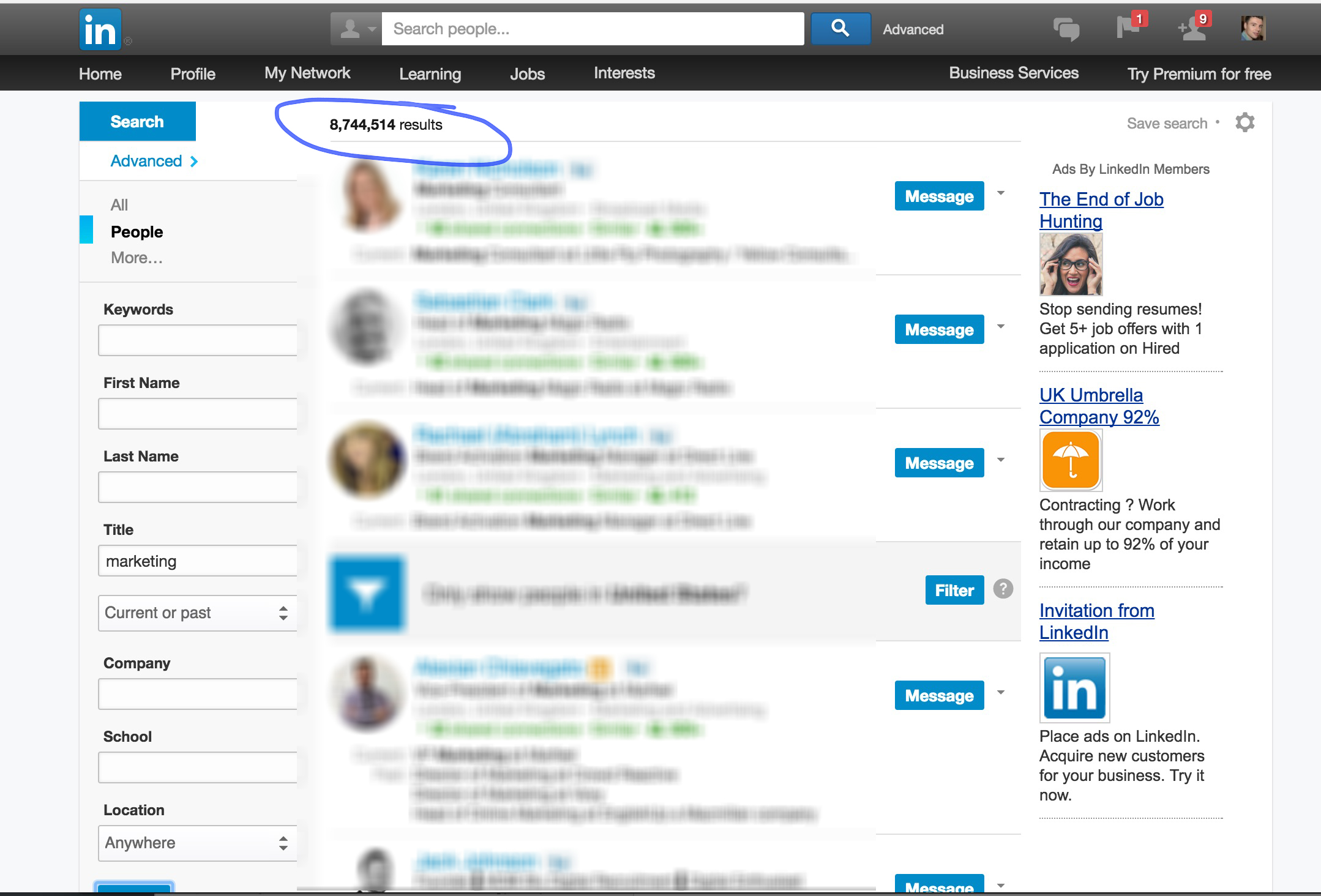

- LinkedIn – this can be an excellent tool for quickly assessing market sizes, particularly for B2B products. Let’s say you’re targeting online marketeers with a new tool. The chances are that many of these online marketeers will be keen users of LinkedIn. Do a quick search and see how many results you get split by region and this will give you a rough indication of how big that market might potentially be.

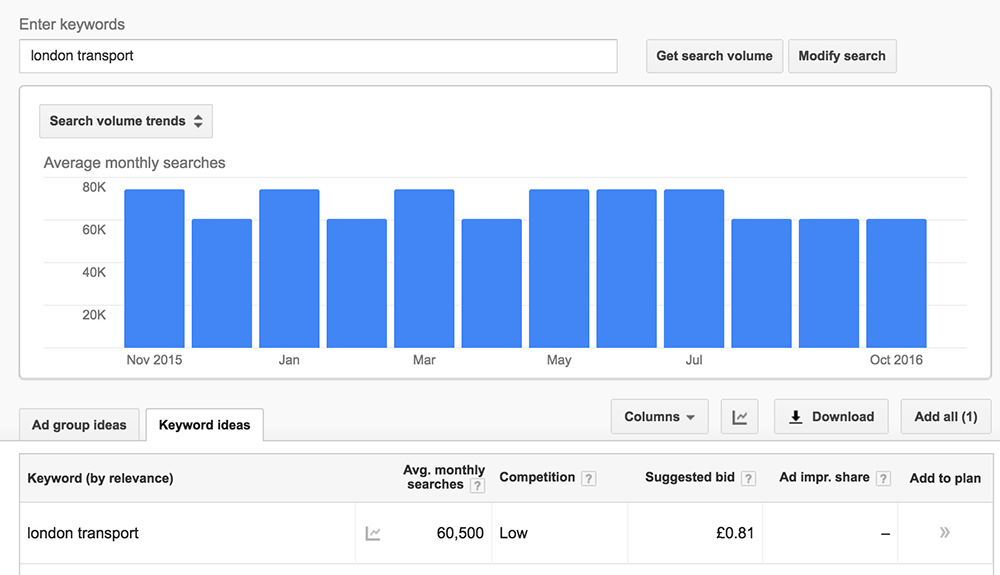

- Google Keyword tool – the Google keyword tool is primarily used by marketing execs and agencies but it’s a useful tool to estimate the popularity of products and services. Simply enter a search term and the Google keyword tool will return the monthly volumes for that specific term, broken down by region and various other dimensions. This helps you to quickly understand if there’s existing appetite for a particular idea or trend. You’ll need a Google Adwords account to be able to do this but it’s fairly easy to set up and it’s worth it.

By no means are these the only methods for quickly gauging the size of a market but they can be useful ways to generate quick ‘back of the envelope’ ideas.

Example

How big is the market for a transport app targeting city commuters?

Some of the metrics you want to consider for estimating the size of the market:

| Metric | Value |

|---|---|

| Number of people in the city | 10m |

| Number of people employed in the city | 2m |

| Number of tourists to city per year | 10m |

| % of people who take the metro every day | 30% |

| % of people who use the metro at least once a week (and would therefore still benefit from an app which helps them navigate) | 40% |

| Average spend per person per year on the metro | 1200 |

| Number of people in city with a smartphone | 7m |

| Number of people in city who use apps | 3m |

| Number of people in city who find navigating painful | 2m |

From a market sizing perspective, you should aim to know these numbers for your product:

- Total number of registered users

- Total number of active users (defined by your product)

- Total number of potential people in your market by country and globally

- Your market share vs. competitor market share

Competition

Are competitors already offering the product you’re looking to launch or is this an entirely new offering? If there are competitors offering similar services, try and get hold of an account so you can conduct your own analysis of that product and figure out what your product can do differently.

Who are your competitors? Think carefully about this.

On the surface you may think about your competition in very limited terms but when you dig a little deeper into the mindset of your potential customers from their perspective you’ll understand that you are competing against a variety of forces which are not necessarily in your industry. For example, a cinema may be competing against other cinemas but they are also competing against restaurants, bars, Netflix, supper clubs and dinner parties. The customer has a time slot (Saturday night) and a budget ($10 – $20) and the cinema needs to provide a compelling reason as to why its value proposition is better suited to meet their needs than its competitors.

Competition is a positive signal; it means there’s an established need that’s being met by other products. Your challenge as a product manager is to establish why your product will approach the problem in a way that uniquely separates you from your competitors and creates new forms of value in previously unexplored ways.

From a commercial perspective, aim to understand how the competition is priced and how this affects your potential commercial offering. Are you going to undercut the competition or try and beat the competition on 1 specific dimension? There are typically 2 ways to compete: 1. Price (often leading to a race to the bottom) and 2. Differentiation. If you can create both a differentiated product and an attractive price point for the users you’re targeting you’re more likely to make the competition irrelevant.

It may be that you take a look at the competition and decide to stick with your own strategy but it’s important that you have an understanding of your competitors and how this impacts your product. Aside from loyal, die hard customers, consumers are seemingly less brand loyal than they used to be and will switch to the competitor who offers them what they want, providing that making the switch is low friction. Understanding your competition and acting accordingly has never been so important.

It’s useful to keep an up to date deck with your competition and check in every few months to see what they’re up to, especially if you’re about to put together a new product strategy / initiative. On a practical level, try and get someone in your team to help out with this; it’s a good idea to get new starters to keep it refreshed since it helps them understand the competitive landscape and accentuates the fresh perspective new people can bring to existing markets. Ask them to prepare a competitor overview to present back to the team and then check your roadmap to understand whether you’re strategy is still strong based on the changes in the market and competitor landscape.

1 word of caution on competitive analysis though; sometimes you can fall down the slippery path of competitive analysis paralysis where you become obsessed with checking on your competitors every 5 minutes instead of focusing on the most important aspect of any product – the value you deliver to your customers. Focusing on delivering the best product experience possible in value adding, margin-enhancing ways is more critical to your product’s success than having an up to date deck on your competition.

Other considerations for market evaluation

Aside from the ability to quickly estimate a market size and evaluate the competition, here are some other factors relating to market evaluation:

- Uniqueness – how unique is your offering? Is it something that is genuinely unique or is it something competitors are offering that your customers now demand? Not all products need to be truly unique; they need to do be created in accordance with your brand / company values in a way that creates value for the customers you’re serving.

- Upfront investment – how much upfront investment is required for the feature / new product to deliver a return on that investment? If it’s going to take a team of large team of developers a more than a few weeks of work, question whether the potential return on that investment is large enough for the investment.

- Evergreen potential – once the product / feature is launched, how much ‘evergreen’ potential does it have? In other words, is your new feature / product time-bound and likely to be irrelevant in a short space of time or is it reasonable to assume that there is longevity baked into it and that it will stand the test of time? It’s clearly difficult to know what’ll happen in the future but it’s a useful consideration when analysing your strategies / roadmap.

Fundamentally the world of business and product exists as a means of transacting and transferring value between people and businesses, whatever form of value your business or product might create

2. Monetization / commercial skills

A surprisingly large number of product managers aren’t commercially savvy and in our own survey of product managers, 31% said they lacked commercial acumen and struggled to come up with monetization strategies. As product people, we come from diverse backgrounds; some are engineers, some designers, some are MBAs. We sometimes feel that monetization is a dirty word and that our job is to focus only on delivering an exceptional experience to the customer. Value to the customer is paramount but so is value to the business and the ability to balance both interests is a skill worth cultivating.

What is monetization?

Generating revenues requires a business model that includes a monetization element. As Jason Goldberg, the founder of the ultimately doomed startup Fab.com put it, ‘you can’t pivot your way to a business model’.

Here are some of the most frequently used monetization models:

- Subscriptions – provide access to value and charge a monthly fee for access to that value e.g. Netflix

- Product sales – create a tangible / digital product and charge a 1 off price for access to or a copy of that product e.g. a copy of Sketch

- Service – provide assistance, software as a service or other forms of value and charge for access to that service e.g. Optimizely

- Reselling – acquire an asset and then resell it / repackage / white label it to customers at a higher price than you originally paid for it

- Leasing – acquire an asset, rent it out to individuals who pay a fee to access it e.g. WeWork co-working space.

- Agency – act as a model between 2 parties to facilitate the transfer of value from party A to party B. Example: advertising agencies connect clients e.g. McDonalds with media owners e.g. New York Times to target a specific audience.

- Audience aggregation – build a specific audience who may be attractive to a third party, sell products and services to the third party in order to access the audience you’ve aggregated e.g. GOOP.com, Gwynneth Paltrow’s lifestyle blog where she now sells advertising and products to the aggregated audience she’s built.

What are the important things to understand about commercials and revenue?

Try and understand your product’s key revenue streams and how your product impacts the overall business revenue. What % of overall revenue do the products you work on account for?

Revenue should ideally be included in your KPIs and considered as part of your strategy development but the truth is that some companies are less focused on commercials than others so it does depend on your situation. Startups, as you’d imagine, are often seeking to prove product / market fit as quickly as possible, whereas larger organisations can sometimes be more focused on revenue since product / market fit has long been established. Monetization also depends on whether your product is B2B or B2C, with B2B products more focused on monetization than B2C.

When making product decisions, consider the potential impact such a decision will have on your bottom line and how monetization can be baked into your product, where appropriate. Ask yourself if there are opportunities to generate new revenue streams where none existed in the past and how you might be able to aggregate or combine existing value propositions into new forms of value which could be monetized in new, value-enhancing ways.

3. Value creation skills

At the core of every product or business is value. In its simplest form, a business exists to deliver value to its customers, typically by solving a problem or meeting a need. Without value, a business does not exist.

As a product manager, it’s a good idea to get to grips with the notion of value so that you understand that fundamentally the world of business and product exists as a means of transacting and transferring value between people and businesses, whatever form of value your product might create.

What forms of value exist?

If I run a coffee shop, I might offer the following forms of value:

- Warm cups of coffee

- Relaxing music

- Fresh, clean cups

- Beautifully decorated interiors

- Bags of coffee for sale

These are what you could consider to be my core value propositions that I offer to my customers as a coffee shop owner. However, there may be opportunities to create new forms of value for my customers which are less obvious, as a result of my core value propositions:

- Workspace – I notice that people are using my space to work and so I decide to charge an hourly fee for access to my work space as a lease.

- Coffee making workshops – my customers are coffee fans so I decide to create a coffee making workshop on weekends where customers pay a 1 off fee to access a 1 day workshop

- Subscriptions – using a different monetization model, I offer my customers 1 bag of coffee a month if they pay a monthly subscription fee

You can see that value propositions are dynamic and can grow and evolve into new forms of value, depending on how consumers consume the original value proposition and the changing dynamics of the market.

Some businesses focus on providing lots of value to lots of people. Others exist to serve a small amount of value to only a few customers but at a higher cost.

As product managers, we are typically the people who both create the value by identifying an unmet need or problem that can be solved and deliver the value through the process of building the products that solve this need. Sales, marketing and finance are equally important parts of this chain but they are supplementary to the value delivery; they ensure that people know about the value, that the value has customers and that the value is delivered in a financially viable way, but at their core, businesses exist as value propositions for their target audiences.

What use is a product if nobody knows about it?! Marketing is the process of attracting the attention of your prospective customers and proving to them quickly that your product solves a problem they have in a way they’re willing to pay for.

4. Marketing skills

What use is a product if nobody knows about it? Marketing is the process of attracting the attention of your prospective customers and proving to them quickly that your product solves a problem they have in a way they’re willing to pay for.

As a product person, it’s useful to think about how the product you’re building could be marketed to the people you’re targeting. Sometimes, product people will work with marketing people and sometimes your role might be a blend of both product and marketing. Typically, the roles of marketing and product will be split, which makes sense for many companies, however it’s a good idea to work closely with sales and marketing so that you understand why the product you’re building will be easily sold and marketed to the people you’re building it for.

Marketing terminology

Here are some key marketing concepts and terminology that are useful to understand:

- Audience addressability and segmentation– how addressable is the market you’re targeting? If you’re launching an advertising campaign, you want to have the confidence to know that your audience is addressable. Thankfully, the web has made addressability far easier than it used to be and we’re now in s a position where you can easily target 31 year old new mothers living in London who have recently had a birthday; something that would have been previously impossible. Addressable markets make it easier for you to target specific groups of people with your product. Markets which are difficult to address include situations where the audience might be embarrassed to admit they belong to that market. For example, someone suffering with an embarrassing disease or illness might be difficult to target since they’d need to actively declare somewhere that they belong to that market; something they’re highly unlikely to do!

- CPA – cost per acquisition. As you probably know, this is simply the amount of money you need to spend on marketing to acquire a customer. An ecommerce business might spend $25 acquiring a customer. If you’re selling product with a retail value of $80 this might be a viable CPA. However, what happens if you have a CPA of $25 but you’re selling products worth less than your CPA or your overheads eat away at your margins? This is where LTV helps offset the initial CPA.

- LTV – lifetime value. This is the value a customer brings to your business across their lifetime. As an example, if you sell products for $25 but your CPA is $30 you might think you’re losing money and your business is unsustainable. However, what many folks fail to consider is that the LTV of a customer, once acquired, can be considerably more than the average order value of their first purchase. In this example, if the customer’s LTV is $120, despite your average product costing less than your CPA, you may still have a viable business model.

- CPC – cost per click. The price you pay for a click. Typically, Google ads and Facebook ads charge per click, but display advertising networks will charge based on CPM.

- CPM – cost per thousand where M = the roman numeral for a thousand. This metric has been used throughout the advertising industry for decades and is typically referred to as CPT in the radio and TV advertising world. Media owners (radio stations, TV channels etc) will have a rate card which they use to charge advertisers on a cost per thousand basis. For example, for every thousand people you reach, they might charge $10. An ad campaign reaching 10,000 people would be 10,000 / 1000 * $10 = $100.

- CTR – click through rate. The % of people who click on your CTA (call to action).

- Remarketing – a fairly recent addition to the marketing landscape but a ruthlessly effective way of driving conversions. Here’s how it works: a user lands on your landing page, you drop a cookie on them and ads will be ‘re-marketed’ to them, following them wherever they go. A controversial, but highly effective way of driving conversions and a tactic often employed by ecommerce businesses to display the products you were browsing a few minutes earlier.

Forms of marketing and advertising

As technology matures and changes, the range of ways to reach customers also changes. Typically, just a few decades ago if you wanted to run an advertising campaign you’d either have to be a large corporate with big marketing budgets or you were a small business paying for classified ads in your local paper. Now, it’s possible to target highly specialised audiences with minimal budgets to sell your products or services on a global scale. Marketing agencies will often spend across a variety of audiences initially to test the impact across a broad category and then refine the audience based upon the results of the initial testing.

-

Traditional media: TV, print / press, radio.

Typically sold on a CPT basis (cost per thousand), where the media owner charges a rate card price in return for reaching 1000 of its customers. Despite the challenges of digital ad spend, billions are still spend on these mediums. -

Advertising networks

Advertising networks buy up traffic across the web and using cookies they allow the advertiser to target audience segments, typically with ‘display ad’ units such as banners, skyscrapers and MPUs. -

Google PPC

Pay per click. Advertisers bid for google keywords (that is, keywords that google users are searching for) and you pay for every click of an ad shown to users searching for particular terms. Google commands 55% of search ad revenues as of July 2016 and continues to dominate today. -

Facebook PPC

Given the ridiculous scale of Facebook, it’s hardly surprising that Facebook allows you to create spectacularly niche audiences using the rich data it has for its users. Advertisers pay on either a PPC or CPM basis to target the audience they’ve created. Google and Facebook now account for 75% of new spending on online advertising leading some to argue they have essentially created a duopoly. -

SEO / content marketing

Search engine optimisation and content marketing is where publishers / businesses create content based on specific keywords and employ tactics to appear high on the results page. -

Other online advertising

Aside from the mainstream online advertising outlined above, there are countless other ways to target users online, including podcast sponsorships, ad funded content (where advertisers create content in collaboration with publishers), product placement and several other innovative ways to reach people online. - Growth hacking

A newly coined phrase, growth hacking refers to innovative ways to drive business growth, outside the conventional ways. For example, Hotmail became huge in the 90s by simply including a link to Hotmail in its footer. Growth hacking become a phrase synonymous with BS so avoid saying it out loud unless you have an outstanding idea. You can’t growth hack your way to finding product market fit. -

PR

Public relations. A slightly outdated way of promoting your product and services, PR agencies will try and generate press mentions and talkability for your brand. Think Ab Fab with a few graphs. -

Email marketing

Surprisingly, good old email marketing is still one of the most effective ways of driving sales for many businesses. Email marketing is widely employed by both large companies and smaller blogs / niche sites to engage with audiences. Open rates hover between 10 – 20% depending on your vertical with CTRs around 4%.

5. Strategy skills

Have you ever been asked to put together a product strategy by your leadership team, only to walk away and think where on earth do I start? You’re not alone.

Effective product strategy involves making a series of hypotheses to test. At the heart of strong strategy is decision making and strategy a powerful way of deciding where you’re heading as a business, where you position yourself in the market compared to your competition and ultimately how you’re going to achieve your goals.

To come up with a strategy you need to ask yourself some key questions:

- What problem does your product solve and for who does it solve it?

- What are your goals? What are your objectives and what are they key results that demonstrate that you’ve achieved these goals?

- What is the 1 thing that you want customers to think about when they think about your company?

- On what dimension are you going to beat your competitors or make them irrelevant e.g. price, range of offerings, etc

- What is truly unique about your product and why?

- What can you eliminate from your existing model to simplify our offering to the market?

- What new offerings can you bring to the market that have never been created before?

- What new areas of your market and other markets can you potentially capture with your product and how?

When putting together your product strategy, one useful exercise is to create a strategy canvas. This is where you create a visual diagram of where your product sits in the market place vs. the competition to clearly identify how your product is different to the competition.

How to create a product strategy canvas

The product strategy canvas is a simple diagram which can be used to convey to the rest of the business and your team why your product is set up to compete and add unique value to your market.

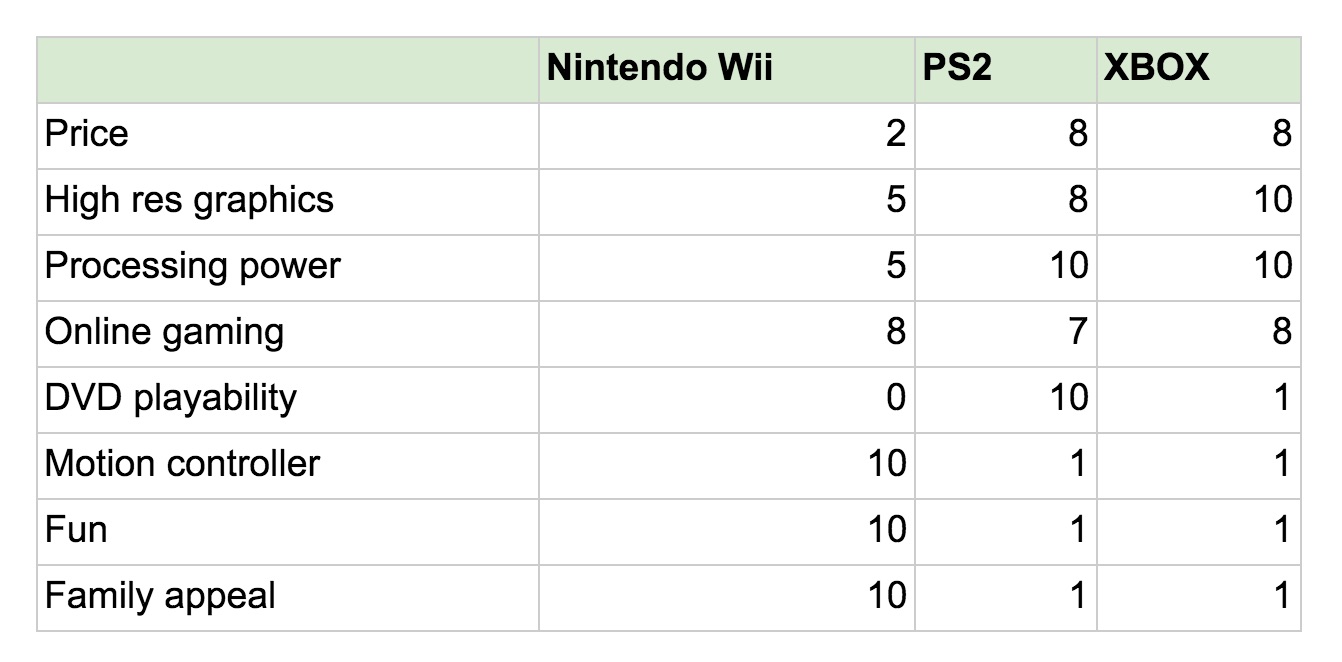

To learn about how to create a product strategy canvas we’ll use Nintendo Wii as an example.

Step 1 – list your factors

List all the factors on which your product competes in the market it operates e.g. price, high resolution graphics, processing power, online gaming.

Step 2 – create a new value curve

Attempt to create a new value curve by looking at all your factors and distorting them:

- Reduce – which factors can be reduced well below the industry’s standard?

- Eliminate – which factors that the industry takes for granted should be eliminated completely?

- Create – what new factors can be created that the industry has never offered?

- Raise – which factors should be raised well above the industry’s standard?

Here’s the Nintendo Wii example, with all the factors in a table.

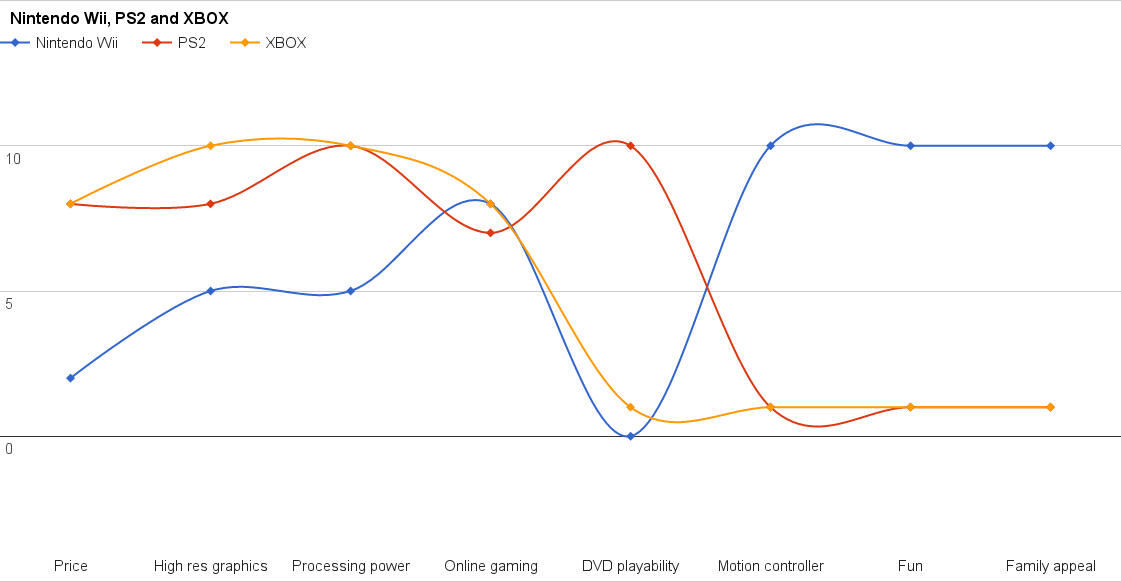

Step 3 – create your diagram

Turn your table of dimensions into a graph which clearly demonstrates the strategic position of your company / product. This is your product strategy canvas.

In this example, you can clearly see that Nintendo sits apart from its competition since it has:

- Reduced price

- Eliminated extra features such as DVD playability

- Created a new way to interact with games with its motion control

- Raised the sense of fun and family appeal way beyond the traditional games market

The product strategy canvas is an extremely useful way to demonstrate to the rest of your business what your strategy is vs. your competitors in the marketplace and using this in your strategy deck clearly shows that you fully understand the market in which you operate and why your product sits apart from the rest.

In summary, product management is a combination of 3 core skills (technology, business and design / UX). We tend to excel in 1 or 2 areas but rarely 3. This post touches on some of the core business skills required as a product person. If you have any further thoughts / insights please do get in touch!

Further reading

- On markets – Zero to One by Peter Thiel

- On value creation – Personal MBA by Josh Kaufman

- On strategy – Blue Ocean Strategy by W Chan Kim

- On marketing – Growth Hacker Marketing by Ryan Holiday